For clarity, where we have used the terms “lowest” or “best” these relate solely to the rates of interest offered by the provider and not on any other factor. The application of these terms to a particular product is subject to change without notice if the provider changes their rates. The advancements of technology and creation of a largely accessible digital marketplace allow Australians to both provide and access goods and services in a way unforeseen when GST was initially introduced. We currently support the following tax years for GST calculation in Australia, if you require additional tax years, please get in touch and we can add them to the list of available what is the debt to asset ratio and how to calculate it tax years. To calculate potential GST savings when selling your business as a ‘going concern’, you may use the Australian Business GST Calculator.

Australia GST Calculator 2024

You can quickly work out the cost of a product excluding GST by dividing the price of the product including GST by 11. You then multiply that figure by 10 to calculate the value of the product excluding GST. Understanding the GST and how to calculate it is essential for anyone doing business or shopping in Australia. A GST calculator is a simple, effective tool that can make this task much easier.

However, when the revenue of your business hits the $150,000 mark, it becomes mandatory to sign up for GST within a span of 21 days. Once you become eligible for GST registration, you have a 21-day deadline to complete the process. A single GST registration covers all your businesses if you operate multiple businesses. This method is used when adding GST to a sale amount where the price does not include GST. Here is a step-by-step guide on how to calculate your GST return and payment in Australia.

Australia Reverse GST Calculator 2024

GST was finalised by the Australian government toward the end of 1999, and commenced on 1 July, 2000. It was an ambitious replacement to the previous wholesale sales tax system, and also included the phasing out of various State Government taxes and duties, along with bank taxes and stamp duty. If you’re considering bringing goods into Australia, the Goods and Services Tax (GST) that applies may vary. This depends on the nature of the items you’re importing and whether they’re intended for personal consumption or for business purposes, such as resale.

- This has led to a decrease in the GST-to-GDP ratio from 4.0% in 2003–04 to 3.3% in 2018–19.These figures highlight the importance of understanding and accurately calculating GST.

- If you want to quickly calculate or double-check the GST on complex figures, you can use our GST calculator.

- We have included the GST formula for Australia so that you can calculate the GST manually or update your systems with the relevent GST rates in Australia.

- The application of these terms to a particular product is subject to change without notice if the provider changes their rates.

- To calculate the GST on the product, we will first calculate the amount of GST included, then multiply that figure by 10% (The GST rate).

If your organization isn’t registered for GST, the department will only cover the funding amount that’s been approved, excluding GST. So, unlike organizations that are registered for GST, they won’t be adding any GST on top of the funding they’ve already approved. No matter how many businesses you run, you only have to sign up for GST a single time. You have the flexibility to register either online, via a phone call, or through an agent when you’re setting up your business for the first time. If you are looking to add GST to your product for GST inclusive sales rates in Australia then please use the Australia GST Calculator for 2024 here.

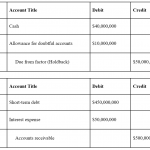

Calculating GST on sales (GST Collected)

The Australia GST Calculator will provide a table which specifies the product/service price, the product/service GST amount due and the total cost of the product or service in Australia. The Australia Reverse GST Calculator will provide a table which specifies the product/service price, the product/service GST amount due and the total cost of the product or service in Australia. Please note that the Australia GST Calculator is designed to allow you to toggle between quick and Detailed calculations without losing any data that you add to the Detailed GST Table.

Whether you live in Brisbane, Victoria, New South Wales(NSW), or Sydney, GST applies to the overall country. The calculator provided on money.com.au is intended for informational and illustrative purposes only. The results generated by this calculator are based on the inputs you provide and the assumptions set by us. These results should not be considered as financial advice or a recommendation to buy or sell any financial product. By using this calculator, you acknowledge and agree to the terms set out in this disclaimer. For more detailed information, please review our full terms and conditions on the website.

John imports $20,000 worth of tools into Australia for sale through his business. If you want to quickly calculate or double-check the GST on complex figures, you can accrued expenses invoice payroll commissions accounts payable accrued liabilities use our GST calculator. For organizations that have already registered for GST, department will cover the GST amount in addition to the approved funding. Once a business signs up for GST, it’s generally expected to stay registered for at least a year.

The standard GST rate free accounting software for small business in Australia is 10%, but in some cases, this rate could be higher, luxury items may have a higher GST rate while others may be GST FREE. One of its key features is its multi-stage nature, which means the GST is collected on every step of a product’s journey, from raw materials to final purchase.

GST Calculation Formula

This ensures transparency and accountability in the financial dealings of the organization. So, whether you’re a business owner figuring out how much GST to charge or a consumer trying to understand how much you’re really paying, this article is for you. Let’s explore the workings of a GST calculator, its applications, and why it’s an indispensable tool in Australia. Visit the page GST Registration, here is a complete step-by-step process with images to register your business via the ATO business portal. For example, if the total amount of the goods or services purchased is $1000, then the GST amount can be calculated as follows, given that the current GST rate in Australia is 10%.